The Comprehensive Guide to Mortgage Brokers: Roles, Duties, and Earnings Potential

Introduction

Did you ever ponder about the role a mortgage broker play in securing dream homes? This article aims to elucidate the world of mortgage brokers, their tasks, potential earnings, and the path to becoming one. Whether you’re an aspiring homeowner or a finance aficionado, this insightful guide is for you.

Unveiling the Mortgage Broker

A mortgage broker, essentially a financial specialist, acts as a conduit between borrowers and lenders throughout the home loan procedure. They tap into a wide array of loan products and utilize their extensive market knowledge and lender relationships to help clients find suitable loan options, striving to secure the best mortgage rates and terms.

Differentiating Between Mortgage Brokers and Lenders

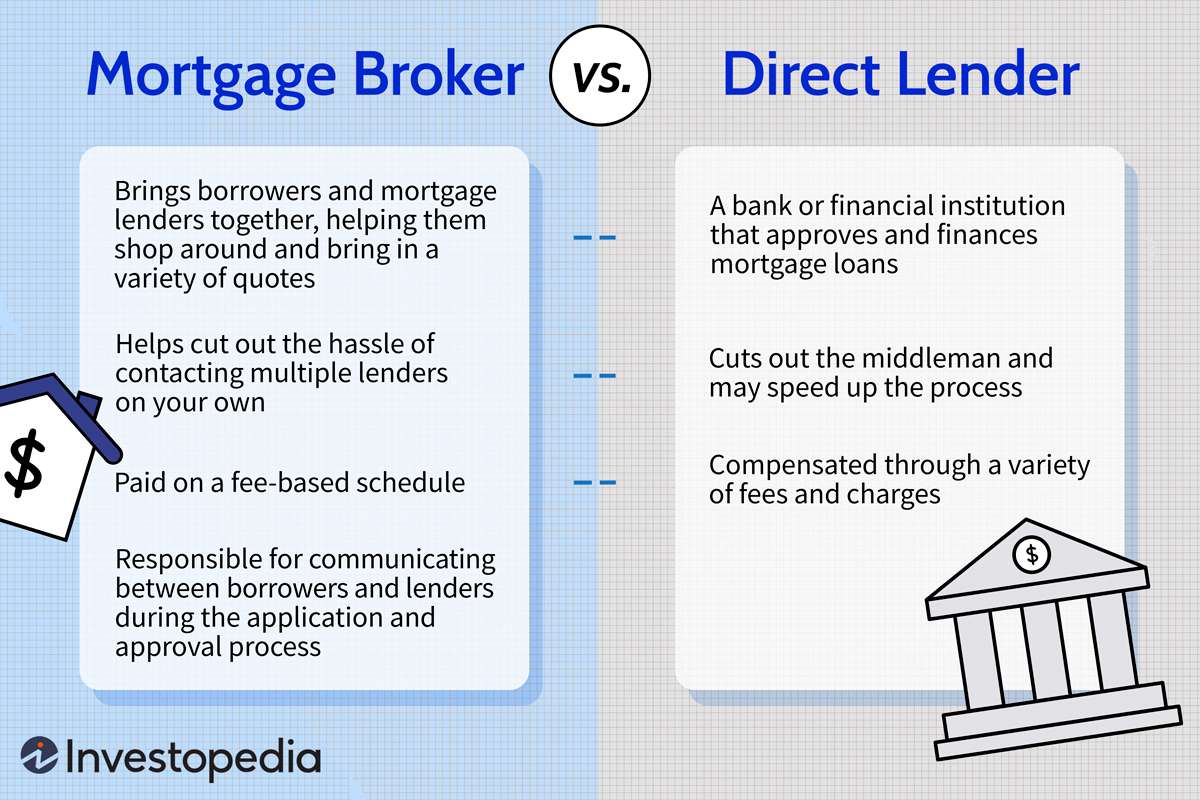

It’s crucial to distinguish between mortgage brokers and lenders in the home loan process. While brokers work as intermediaries, offering impartial advice and wider loan options, lenders are the institutions providing the funds for the mortgage, usually limited to their specific loan products. This differentiation implies that working with brokers can offer more choices and flexibility, while dealing directly with lenders may expedite the process.

Diving into the MB’s Duties

Mortgage brokers undertake various responsibilities in the home loan process:

- Examining Borrower’s Financial Situation: Brokers assess financial documents to determine mortgage eligibility.

- Researching and Recommending Loans: They suggest suitable loans based on borrower’s financial conditions and needs.

- Assisting with the Application: Brokers help in completing and submitting the loan application.

- Interacting with Lenders: They act as primary contacts, negotiating loan terms for clients.

- Navigating Through the Mortgage Process: Brokers simplify the mortgage process by answering queries and clarifying complex concepts.

The Path to Becoming a Mortgage Broker

If you’re intrigued by the prospect of becoming a mortgage broker, follow these steps:

- Education: A background in finance, business, or economics can be helpful.

- Licensing: Brokers need to acquire licenses, which often involve completing pre-licensing education, passing an examination, and fulfilling certain experience requirements.

- Acquiring Professional Certifications: Obtaining certifications such as the Certified Mortgage Broker (CMB) can bolster credibility.

- Gaining Experience: Experience in roles related to loan origination or processing can offer valuable insights and connections.

- Continuing Education: Keeping up-to-date with industry norms, market trends, and regulations is crucial.

Shedding Light on Salary

The earning potential of mortgage brokers hinges on factors such as experience, location, and volume of loans closed. Brokers usually earn a base salary plus commission, with the average salary fluctuating between $50,000 and $100,000 annually. Exceptional brokers can exceed this range, with commission rates typically ranging between 1% to 2.5% of the loan value.

Distinguishing Between Mortgage Brokers and Loan Officers

While both roles exist in the mortgage industry, they have marked differences. A mortgage broker is an independent professional offering a plethora of loan products from various lenders, whereas a loan officer is typically an employee of a financial institution, guiding borrowers through their institution’s loan application procedure.

Wrapping Up

Mortgage brokers are vital cogs in the home loan industry, simplifying interactions between borrowers and lenders, and facilitating the mortgage process. Whether you’re an aspiring homeowner or mulling over a finance career, leveraging the expertise of a qualified mortgage broker can significantly bolster your chances of securing an ideal loan and acquiring your dream home.