Achieving Your Savings Goals in 2023: An Effective Strategy

Accomplishing your savings goals in 2023 can seem like a daunting task. However, with a detailed plan and a few strategic steps, you can make significant strides towards your financial aspirations. Here’s a comprehensive guide on how to meet your savings targets this year.

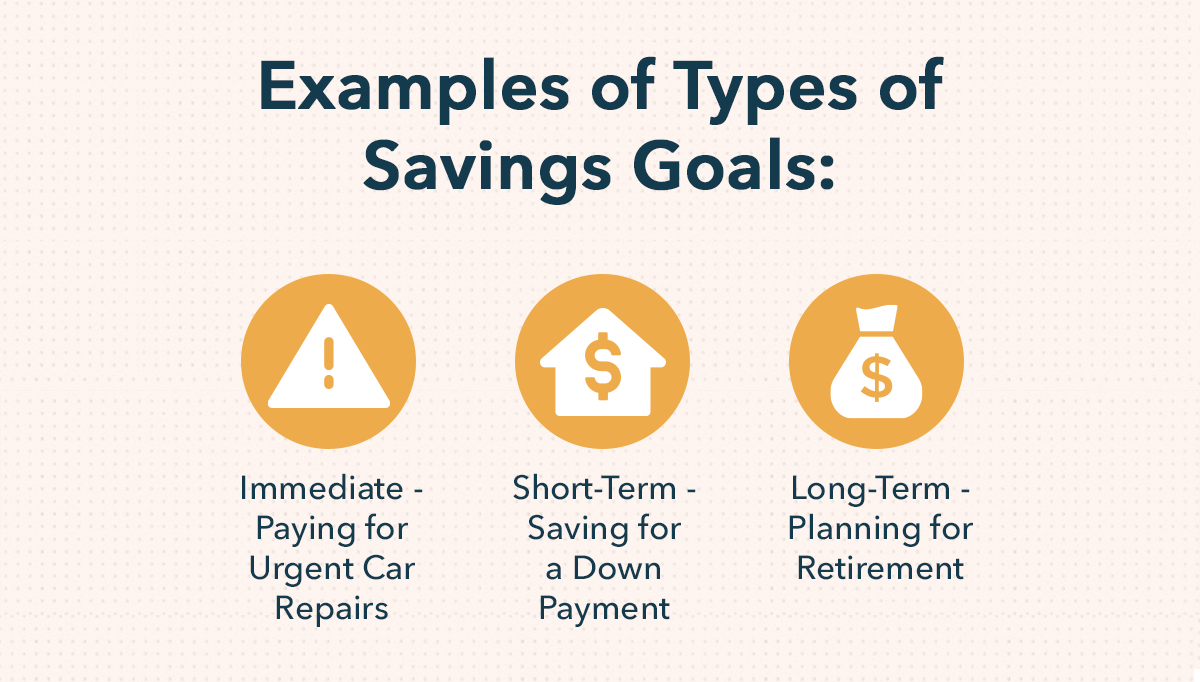

1. Define Your Financial Aspirations

The initial step in propelling your savings goals is to determine what they are. Are you accumulating funds for a home, an emergency stash, retirement, or a dream vacation? Your targets will shape your saving methods. Establish SMART targets: Specific, Measurable, Achievable, Relevant, and Time-Bound. For instance, rather than saying, “I wish to save more,” specify, “I wish to save $10,000 for a house down payment within two years.”

2. Establish a Budget and Adhere to It

A budget is a financial roadmap that guides you to manage your income and outgoings. Set aside a certain portion of your earnings for savings and prioritize it. Make use of budgeting apps and tools to monitor your expenditure and savings and adjust accordingly to stay on course.

3. Automate Your Saving Process

Automating your savings process is a highly effective way to push your financial targets forward. Arrange for automatic transfers from your current account to your savings account at regular intervals, such as weekly, biweekly, or monthly. This method allows you to save money effortlessly.

4. Cut Back on Non-Essential Expenditure

Assess your outgoings and pinpoint areas where you can economize. This could encompass dining out, entertainment, subscriptions, or other discretionary purchases. Every saved dollar can contribute towards your financial objectives.

5. Consider High-Yield Savings Accounts

High-yield savings accounts offer higher interest rates than ordinary savings accounts, aiding your money to grow more swiftly over time due to compound interest. However, ensure you research and compare various high-yield savings accounts to get the best rate.

6. Diversify Your Earnings

If feasible, explore ways to diversify your earnings. This could entail taking up a part-time job, freelancing, or investing in stocks or real estate. This extra income can be channeled directly into your savings.

7. Stay Informed About Financial Trends

Keep abreast of financial trends and news. Economic shifts, interest rate changes, and new saving tools can all influence your financial strategy. Consider subscribing to financial news platforms or following financial experts on social media.

8. Maintain Your Motivation

Achieving your savings goals is a marathon, not a sprint. It’s crucial to keep your motivation levels high and remember the reason you started saving. Regular reviews of your targets and progress can help maintain your motivation.

Keep in mind that everyone’s financial circumstances and goals are unique, so adapt these strategies to suit your individual needs. By following these steps, you can make considerable progress in achieving your savings goals in 2023.